-

Does Female Leadership Impact Firm Financial Performance?

Emersyn Alberici

Women make up 47.0% of the labor force and 50.8% of the United States population, but only 40% of managers, as of 2019. In recent years, more and more women are taking on leadership positions, provoking widespread speculation and debate on the impact a female CEO would have on the financial success of a firm. The data is hand collected from various sources, including LinkedIn, Bloomberg Profiles, and Yahoo Finance; compiled into one dataset from 1978 to 2021. Companies included are different Fortune 500, Fortune 1000, and S&P 500 companies transitioning from a male CEO to a female CEO. This paper will investigate and evaluate the impact of a female in the chief executive officer position on the financial performance of a firm. Additionally, I examine the impact of the change in leadership on specific industry sectors. We hypothesize that if there is a female CEO, the stock returns of the firm will increase.

-

Medicare Advantage: Impact of Oscar Entry

Drew Blackmun

The Medicare Advantage program allows for eligible beneficiaries to opt out of public Medicare plans offered by the government, and instead choose from a multitude of private insurance plan offerings. My goal is to analyze the competition within Medicare Advantage in counties surrounding New York City. In 2020, a new health insurance company, Oscar, decided to enter the MA market in the NYC area. I use Oscar’s entry as the main focus of my analysis. To understand the competition, I examine key features of plan design and prices of a number of large MA plans. I also analyze the change in plan offerings and enrollment levels after Oscar entered the market. My hypothesis is that Oscar entry led to lower prices and higher benefits. For Oscar to survive in the market, they must understand what factors contribute to growth in enrollment. Oscar must understand how to make themselves more attractive to eligible beneficiaries in order to absorb significant market share from the big players that are already well established. The information displayed is a result of preliminary exploration, as this is still the first term of my thesis. The data and summaries provided will be further analyzed to draw more significant conclusions that answer the questions of how plan designs impact enrollment and how the entry of new company plans into the market impact the design of existing plans.

There are some conclusions to draw from the information provided. MA enrollment grew significantly between 2019-2021. The big players in the market saw the largest increase in enrollment. Healthfirst Healthplan jumped from 45,000 enrollees to 55,000 enrollees and Aetna Life Insurance increased from 20,000 to 25,000. Many of the smaller players saw little increase, or even decrease in enrollment over the time period, making the market somewhat more concentrated. Oscar was able to obtain 2,083 enrollees which is higher than four other plans in the four counties where Oscar exists. There were also some conclusions to take from plan designs. Starting with premium, many plans offer a $0 premium, including Oscar, but some of the biggest players do charge a premium. Many deductibles were increased after Oscar entered the market, and Oscar chose to offer the highest available deductible of $445. Finally, many plans increased their out-of-pocket maximum from $6,700 to $7,500. Oscar chose to offer an OOP max that falls towards the middle of available plans at $6,700.

-

Early 20th Century Industrialization: Equitable Income Growth Through Manufacturing Productivity Improvement

Leo Cavedagne

The rapid industrialization occurring from the late 19th century into the early 20th century provides the opportunity to study the impacts it brought for American life. Specifically, this paper investigates how changes in labor productivity from the rise of industrialization impacted total, personal, and corporate income per capita at the state level. Our data is from the Statistics of Income Report and the Statistical Abstract of the United States which is used to collect information spanning from 1899-1940 across 49 U.S. States. Our results show a statistically significant and positive relationship between labor productivity and total, personal, and corporate income per capita. Personal income per capita has the highest coefficient, showing that workers benefited more from the increase in labor productivity than corporations.

-

Synergies & Stocks

Kevin Chaimowitz

This paper seeks to analyze the financial impact of Mergers ad Acquisitions in the United Sates stock market. Previous work has found mixed results based on the time period, payment method, deal size, etc. I select recent data (2007-2017) from the Bloomberg terminal and employ an ordinary least squares regression. 70 merger companies, along with 70 similar control companies are selected for a bootstrapping approach. I look at the merger impact based on 3 channels for 1 year, 1 quarter and 1 month. The data illustrates that M&A does not lead to significant negative nor positive abnormal returns.

-

How Does Trade Policy Uncertainty (TPU) affect investor sentiment?

Lily Dong

This paper uses the S&P 500 index as a proxy for the market and follows the methodology in Bijl et al. (2016) to compute an investor attention index by searching company names listed on the S&P 500 index from 2010 to 2019 on Google Trends. Building upon existing literature, this paper proposes a new model that explains the relationship between trade policy uncertainty (TPU) and investor attention. It is shown that these two variables are positively correlated.

-

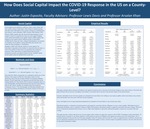

How Does Social Capital Impact the COVID-19 Response in the US on a County-Level?

Justin Esposito

This study investigates the impact of social capital on the United States COVID-19 response on a county-level. Specifically, this paper examines the impact of the bonding versus bridging social capital distinction put forth by Putnam (2000) and the social capital theories of Bourdieu (1986). These social capital variables are analyzed in respect to their outcome on the COVID-19 response characteristics of the willingness to wear a mask in public and the percent change in time spent at home during the pandemic. Using the most recent social capital (2014 and 2019), mask wearing (2020), and social distancing data (2020-21) to perform ordinary least squares regressions. This paper estimates that bonding and bridging social capital does not impact the willingness to wear masks in public. However, we estimate that bonding social capital is negatively correlated with the percent change in time spent at home, and that bridging social capital is positively correlated with the percent change in time spent at home. Also, this paper estimates that income equality is positively correlated with both the willingness to wear a mask in public and the percent change in time spent at home during the pandemic. Educational equality was also estimated to be positively correlated with the percent change in time spent at home. Lastly, this study estimates that educational equality is both positively and negatively correlated with the willingness to wear a mask in public, dependent on the level of educational attainment that is most present in a county. If college educational attainment is held constant, we estimate educational equality to be negatively correlated with the willingness to wear a mask, however if high school educational attainment is held constant, we estimate educational equality to be positively correlated with the willingness to wear a mask. Social capital is found have both a positive and negative impact on the COVID-19 response in the US, it is dependent on the type of social capital being analyzed.

-

The Resilience of Entertainment Over Business Cycles

Lindsay Gerrato

There are several economic, political, social, and psychological factors that motivate consumers’ spending decisions. Whatever their motivations may be, consumer expenditure makes up one of the most crucial aspects of the economy. While consumers hold power in the economy, they are also vulnerable to shifts in business cycles over time. In the past several decades there have been significant depression, recession, and expansion. The impact of these cycles on consumers is quite nuanced and has been studied on aggregate. In this paper, I contribute to the literature by assessing the heterogeneous effect of business cycles on different sectors of consumer expenditure on both a macro and micro level. I focus on consumer expenditure on entertainment, while comparing it to a baseline of consumer spending on durables. There is also a persistent question about which, if any, industries are resilient to changes in business cycles. Do “recession-proof” industries exist? Consumption of entertainment and leisure goods have been suspected to either be unaffected by recession or see an increase in consumption in times of economic downturn. This paper makes crucial strides in explaining substitution effects and changes in marginal utility in the face of economic expansion and contraction. By regressing consumer expenditure on entertainment and certain specific entertainment purchases on Gross Domestic Product, I explore to what extent overall economic health dictates consumption of such leisure goods. I also examine the effect of business cycles over time on consumption of non-entertainment goods, in order to make conclusions about the heterogeneity of consumer spending across business cycles.

-

Assessing a Potential Correlation Between Housing Prices and School Quality, as Measured by Academic Performance Metrics

Alexander Glehan

School quality is one of the most important factors to prospective homebuyers. Study had two purposes:

- Determine if there is a correlation between school quality and housing values in Westchester County (New York)

- Determine if a potential correlation between school quality and housing prices varies by race

Data available from the New York State Education Department and PolicyMap.

-

The Effect of ESG Rating on Financial Performance and Green Bond Issuance within the United States

Ryan Helmig

This paper explores the relationship between Environment, Social, and Governance (ESG) ratings and their effects on performance as well as corporate green bond issuance. In 2019, the United Nations declared that there is only 11 years left to act before there is irreversible damage from climate change. Even though ESG scores have been around for decades, they have only recently become a popular investing subject. However, there is a downfall from there being no clear scoring equation like there is in the rest of finance, GAAP Accounting for example. Companies like MSCI, Refinitiv, and Bloomberg have emerged as leaders in this space to provide data and weighted scores for each of the Environmental, Social, and Governance spaces, and combining them all into one ESG score for a company. Green bonds on the other hand started in around 2007. This market has grown substantially within the past decade. Roughly $157 billion worth of bonds labeled as “green” were issued in 2019. Since sustainable investing is a relatively new subject, there is a lack of literature and previous studies done on the topic. However, there have been some studies that have looked into ESG and green bonds' impact on performance and pricing. For example, Buallay (2017) looks into ESG scores and their impact on performance with a focus on the European banking sector. Buallay defines performance by using the Return on Assets (ROA), Return on Equity (ROE), and Tobin’s Q (TQ). In her study, she finds that ESG is in fact related to positive performance of the banks. Other studies on the green bond market have also looked into the pricing and ownership of green bonds relative to conventional ones. Baker et al. (2018) finds that green bond ownership is very concentrated and investors are paying a premium. This means that investors are giving up returns for better social performances. This paper will analyze if ESG ratings are associated with performance for public companies within the United States and will also look into the impact that ESG rating has on corporate green bond issuance with a focus on the past decade.

-

Examining the impact of the US Federal Reserve's Quantitative easing on Bank Lending, 2009-2012

George Herold

This poster examines the impact of the Federal Reserve's unconventional monetary policy actions in response to the Great Recession, and specifically how Large-Scale Asset Purchases (LSAPs) affected bank lending behavior from 2009-2012. Ultimately, I find that the purchasing of Treasury Securities along with MBS (Mortgage-Backed Securities) significantly and positively impacts bank lending, largely through the channel of portfolio rebalancing and increased leverage.

-

Effects of COVID-19 Pandemic on Consumer Behavior in Retail Stores during April-June 2020

Jack Koch

This thesis seeks to analyze the effects that the most common policies aimed at limiting the spread of COVID-19 had on consumers’ willing to shop at retail stores during first wave of pandemic (April-June 2020).

-

Trends in the Adoption of Digital Health Technology

Benita Lopez

As Covid-19 has stretched healthcare resources thin, digital health technology has sped up innovation to offer more efficient mechanisms to deliver care. Defined as the tools used to empower individuals to improve their health and wellness, digital health technology has the potential to significantly improve the healthcare system. While investment in the industry continues to grow, divisions exist between who actually uses the technology. My thesis seeks to understand how the adoption of digital health has evolved over time, how it varies across demographic features and to identify what similarities different groups of digital health customers share. Using national survey data from Rock Health, I find overall digital health adoption rates are increasing over time but dropped slightly in 2020. More specifically, individuals are searching for in-person services and receiving care electronically (with live video being an exception) less but are owning wearables and tracking digital health metrics more. Age, income, education, gender and health rating all significantly impact whether an individual chooses to adopt digital health. Using K-Means clustering, I find three distinct customer segments with their own defining features: group one is defined as young, healthy & wealthy and has the highest adoption rates, group two is middle-aged, moderate income & fair health, and group three is old, lower-income & unhealthy with the lowest adoption rates. I conclude with what needs to be done to increase the engagement of individuals in group three.

-

The Effect of the CARES Act on GDP Growth Rates at the State Level

Thomas Mello

Do stimulus payments from the government play a significant role in improving GDP growth at a state level?

-

COVID-19 Dilemma: Signaling Effect on Cooperative Behavior

An Nguyen

Inspired by the phenomenon where people panic buy in the face of the COVID-19 pandemic, this paper studies cooperation in Prisoner’s Dilemma games. I explore relatively novel aspects of the Prisoner’s Dilemma literature, that is the effect of information signaling cooperative or noncooperative behavior on outcomes. With randomly-matched, one-shot Prisoner’s Dilemma games conducted on virtually, the study looks to answer the question of how signaling information affects players’ behavior. By studying this effect, the paper hopes to contribute to the existing literature of monitoring on the Prisoner’s Dilemma game and provide some insights on possible public communication strategies to prevent panic buying, as well as other socially detrimental behaviors, mimicking the portrayal of panic buying and the pandemic in the media.

-

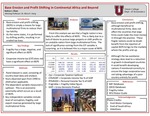

Base Erosion and Profit Shifting in Continental Africa and Beyond, a Comparative Analysis

Nathan Olsen

Base erosion and profit shifting is a result of our increasingly globalized world. What began as large and innovative firms pursuing new markets beyond their home country’s shores, became an extremely effective means to minimize their corporate income tax burden. As the practice of profit shifting has grown in popularity among large multinational firms, so has the desire to understand the effects the practice has on all parties involved. The purpose of this thesis is to determine and understand the relationship between base erosion and profit shifting, country level corruption, and the fragility of independent states, and the effects it has on them.

-

Power of the Policy Burden: Effects of State Ownership on Employment in Vietnamese firms

Jack Pierre

Around the world, State-Owned Enterprises (SOEs) continue to serve important purposes in many economies. Some of the fastest growing economies such as China, Vietnam, or South Korea have used SOEs to drive recent economic growth. SOEs are used by many countries around the world for policy burdens, which vary from profit maximization. My paper concerns tries to analyze the effects of the policy burden by looking at differences between private enterprises and state owned enterprises.

-

Evaluating the Impact of One Belt One Road Initiative on the Gravity Estimates of Partner Countries

Aarya Rijal

The introduction of One Belt One Road Initiative (OBOR) has had a great deal of impact on the integration of China to the global economy. This paper attempts to understand the impact of the initiative on China’s trading partners. This paper looks at the gravity estimates of China's trade partner countries before joining the OBOR initiative using data from 2007 to 2012, and compares it with the gravity estimates after joining the initiative using the data from 2013 to 2017. Initially, this paper looks at the textbook gravity model, which only takes into account GDP and distance between two countries. The add-ons are later added to evaluate the specific impact of policy changes introduced by the OBOR initiative.

-

Using Difference-in-Differences Analysis and the Kocyk Geometric Lag Model to Estimate Aspects Carbon Tax Effectiveness in Nordic Countries

Kyle Riley

This poster generally looks at the connections between carbon taxes and carbon emission levels in Nordic countries over a period from the 1960s to the early 2010s. Most of the existing literature on this topic looks at and finds that carbon taxes do have a significant impact upon carbon emissions levels in some countries while not in others. In many countries which have this policy there is not a significant impact that can be seen and there is a discussion as to why this might be the case and what needs to be done to fix these potential issues to effectively combat climate change. There are many other ideas about what policies may or may not lower emissions levels, and one such idea is looking at how carbon taxes might become less effective reducing carbon emissions. This presentation attempts to take a more in depth look at the way carbon taxes impact emissions levels and how the effectiveness might change and deviate over time.

Using different econometric approaches, this paper asks a slightly different question than what most of the existing literature looks at. Instead of looking at the short-term impacts of carbon taxes on carbon emissions this paper looks at this question from a longer-term perspective where the effect of these taxes can change and deviate, especially if the rate of carbon taxes is not updated to a degree where it keeps up with increasing price levels within a country. This is where the Koyck geometric lag model is used. Another approach which is used throughout is to use difference-in-differences analysis where a control country with no carbon taxes is used to compare to treatment countries which have active carbon tax policies to look at the differences in emission levels between countries which do and do not have tax policies. This style of econometrics is utilized to somewhat simulate how a traditional scientific experiment would be constructed, by looking at the causal impacts of a policy implementation which in this case is the carbon tax.

-

Analyzing the relationship between SNAP Participation and Private Establishments in America’s Largest Cities During and After Recessions

Corey Rutkin

This paper explores how growing the number of SNAP recipients during recessions and the period following. Specifically this paper looks at how SNAP impacts the growth of private establishments and vice versa. SNAP, the Supplemental Nutritional Assistance Program, tends to increase in recipient size during recessions. This paper specifically looks at the counties where the ten largest cities in the United States are located. The number of SNAP recipients has risen during every one of the last three recessions in every one of these counties except in one instance. That’s 29/30 times. By looking at private establishments, this paper aims to examine two impacts. The first is how increasing SNAP participation impacts the ability of private businesses to recover from a recessions; the second is how protecting private businesses impacts the return to pre-recession SNAP levels.

-

The Effect of Item Presentation (Pictorial, Verbal, and Combination) on Choice Overload and Tendency to Opt-Out of Choice

Julianna (Juls) Sweet

Previous studies support the existence of two phenomena: choice overload, where more choices have negative effects for a consumer; and the pictorial superiority effect, where people prefer pictorial stimuli as opposed to written words. Townsend and Kahn (2014) studied these effects by examining different sized choice sets and stimuli types, specifically pictorial (visual) and verbal (word-based). In this study, I extend the work of Townsend and Kahn (2014) by introducing a combination presentation of verbal and visual elements in addition to the pictorial and verbal presentations studied before. This study examines the effect of presentation of options (pictorial, verbal or combination) and choice set size (8 or 27) on choice overload, measured through perceived variety and perceived complexity, and likelihood to opt out of choice. I anticipate to replicate the findings of Townsend and Kahn (2014). I also anticipate that participants will be more likely to opt out of choice for combination presentation of pictorial and word based stimuli when presented with a choice set of 27 options in comparison to 8 options.

-

The Effect of AI Implementation on Total Factor Productivity

Matthew Toy

The effect of artificial intelligence on the overall productivity of a nation is largely unknown. My research focuses on this gap and attempts to find the impact of artificial intelligence implementation on total factor productivity.

-

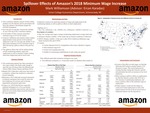

Spillover Effects of Amazon’s 2018 Minimum Wage Increase

Mark Williamson

Throughout the past two decades, e-commerce has exploded in the United States, with Amazon leading the way. Following criticism from the media and politicians, Amazon instituted a nationwide minimum wage of $15 per hour for all employees at the end of 2018. Since Amazon fulfillment and sortation centers employ approximately twenty percent of all warehouse employees in the United States, one must ask whether or not their recent institution of a $15 minimum wage in 2018 has improved overall local warehousing wages in counties with Amazon warehouses present. This paper will answer this question by conducting a quarterly county-level analysis on the American warehousing industry from 2016 to 2020 using QCEW data from the Bureau of Labor Statistics website, comparing counties with Amazon warehouse to counties without them. This paper finds that Amazon’s minimum wage increase in 2018 resulted in lower overall warehouse wages for counties with an Amazon warehouse present due to the increase in lower-level employees in the industry. Moreover, this paper will consider the spillover effects of the minimum wage change onto both employment in the warehousing industry as well as the retail industry. Lastly, the spillover effects of Amazon Air on air travel costs at the airports served by Amazon will be analyzed.

Printing is not supported at the primary Gallery Thumbnail page. Please first navigate to a specific Image before printing.